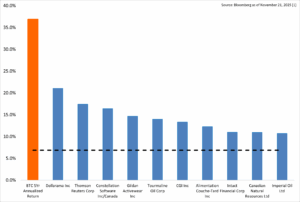

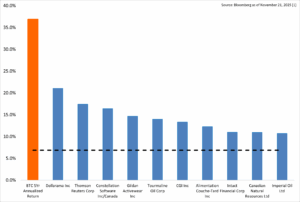

Bitcoin’s Outperformance vs Corporate Canada

Over the past five years, Bitcoin has delivered an annualized return of 36.9%, even after the recent pullback, a figure that eclipses not just broad equity indices, but also the 5-year average Return on Invested Capital (ROIC) generated by the Top 10 companies in the S&P/TSX 60, ranked from highest to lowest ROIC (see Figure 1).

This comparison is striking because ROIC represents how effectively a business turns its capital, its factories, employees, acquisitions, and intellectual property, into profit. Bitcoin, by contrast, requires no operations, no supply chains, and no overhead. And yet, simply holding Bitcoin has delivered returns that far exceed the productive activities of Corporate Canada.

Figure 1: Bitcoin 5Yr Annualized Return vs 5Yr Average Return on Invested Capital of TSX 60 Constituents (Top 10)

The Case for Bitcoin as a Treasury Asset

Corporate treasuries are built to preserve and grow shareholder value. Traditionally, this has meant holding cash, short-term bonds, or foreign reserves, assets that are considered safe but quietly destructive to purchasing power over time.

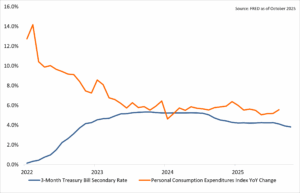

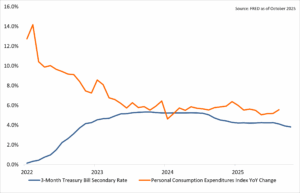

Since January 2022, the 3-month U.S. Treasury Bill, globally considered the quintessential traditional treasury asset, has failed to keep up with inflation.

Measured against the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred gauge of inflation, 3-month Treasuries have only delivered a positive real (inflation-adjusted) yield once in the past 4 years.

Figure 2: 3-Month Treasury Bills vs PCE Index Since January 2022

As shown in Figure 2, even as short-term yields climbed above 5% in 2023 and 2024, inflation continued to erode purchasing power.

Corporate cash balances and fixed-income reserves have been losing real value month after month, meaning that companies “playing it safe” are actually moving backward in real terms.

While traditional treasury assets erode shareholder value quietly through inflation, Bitcoin is emerging as the treasury asset that compounds it.

This is the core thesis behind Bitcoin Treasury Corporation (TSXV: BTCT | OTCQB: BTCFF), a Canadian public company dedicated to holding Bitcoin as a treasury asset. BTCT currently holds 771.37 BTC, and its business model is simple but powerful: hold Bitcoin, benefit from its appreciation, and use the corporate structure to enhance that exposure through capital markets and operational activities.

Beyond Holding: Building Bitcoin’s Financial System

BTCT isn’t just holding Bitcoin, BTCT can earn yield on its holdings through institutional partnerships, while maintaining full exposure to Bitcoin’s price appreciation.

Just as the dollar has developed deep and liquid capital markets, corporate bonds and lending markets, Bitcoin is now building its own financial ecosystem. Over time, this will include Bitcoin-denominated bonds, collateralized loans, structured products, and yield curves that mirror traditional finance, but operate in a system defined by scarcity, transparency, and decentralization.

A New Class of Institutional Holders

As this ecosystem matures, a new class of long-term Bitcoin allocators will emerge, not mere speculators, but underwriters, lenders, insurers, and endowment-like stewards of Bitcoin-denominated wealth. They will play the same role that traditional financial institutions play in fiat markets today, providing liquidity, credit, and structure around the world’s largest digital asset.

Bitcoin has outperformed every major asset class for more than a decade. It’s not just an investment; it’s becoming a cornerstone of a new financial system.

As BTCT demonstrates, the opportunity is no longer theoretical. It’s structural, scalable, and increasingly institutional.

In the era of digital scarcity, holding Bitcoin is not speculation, it’s capital discipline.

[1] 5YR Average Return on Invested Capital for S&P/TSX 60 companies calculated as the simple 5-year average of the Return on Invested Capital. Return on Invested Capital is calculated as (Trailing 12-Month Net Operating Profit After Tax ÷ Average Invested Capital) x 100.

Follow us on X and LinkedIn for regular updates.

—-

Investors are not to construe the contents of this blog as legal, tax, accounting or investment advice. Investors should be aware that the acquisition of securities of the Bitcoin Treasury Corporation (“BTCT” or the “Corporation”) will have tax consequences, whether adverse or otherwise. Such tax consequences are not described herein. Prior to investing in the securities of Bitcoin Treasury Corporation, Investors should consult with their legal, investment, accounting and tax advisors to determine the consequences of an investment in the securities of the Corporation, including with respect to their particular circumstances.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this blog.

Cautionary Note Regarding Forward-Looking Statements

This blog includes certain “forward-looking statements” under applicable Canadian securities legislation. Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects” or “does not expect”, “is expect”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, or variations of such words and phrases) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: business integration risks; the Corporation’s operating results will experience significant fluctuations due to the highly volatile nature of Bitcoin; the Corporation operates in a heavily regulated environment and any material changes or actions could lead to negative adverse effects to the business model, operational results, and financial condition of the Corporation; evolving cryptocurrency regulatory requirements and the impact on the Corporation’s business plan; Bitcoin value risk; reliance on key personnel; implementation of the Corporation’s business plan; lack of operating history; competitive conditions; de banking and financial services risk; anti money laundering and corrupt business practices; additional capital; financing risks; global financial conditions; insurance and uninsured risks; cybersecurity risks; changes to bank fees or practices, or payment card networks; audit of tax filings; market for the Bitcoin Treasury Shares; market price of the Bitcoin Treasury Shares; conflicts of interest; internal controls; tariffs and the imposition of other restrictions on trade could adversely affect the Corporation’s business; risk of litigation; pandemics or other health crisis; acquisitions and integration; risk of dilution of Bitcoin Treasury securities; dividend policy; Bitcoin price volatility; custodial risks; technological vulnerabilities; Bitcoin transactions are irreversible and may result in significant losses; short history risk; limited history of the Bitcoin market; potential decrease in the global demand for Bitcoin; economic and political factors; top Bitcoin holders control a significant percentage of the outstanding Bitcoin; availability of exchange traded products liquidity; security breaches; the requirements that accompany being a publicly traded company may put a strain on the Corporation’s resources, divert attention from management, and adversely affect its ability to maintain and attract management and qualified board members; liquidity risk; leverage risk; and share price fluctuations.

Although management of the Corporation believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions and have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements and information contained in this blog are made as of the date of the blog and the Corporation does not undertake any obligation to update publicly or to revise any of the included forward -looking statements or information, whether as a result of new information, change in management’s estimates or opinions, future circumstances or events or otherwise, except as expressly required by applicable securities law.

The TSXV has neither approved nor disapproved the contents of this blog.